ramsey county property tax

Verify the address then click the blue parcel ID number. The average effective property.

|

| Sahan Journal Facebook |

Pay your property tax.

. Ramsey County Property Tax Assessor Info Service. To pay by credit card call the toll free number 800-2PAY-TAXSM 800-272-9829 or visit the Official Payments Corporation website to pay taxes by. Overview of Ramsey County MN Taxes. 1991 STENE FMLY TRUST.

How to pay online. Saint Paul MN 55107. STENE IRENE E WHITE DELORES A. The regular property tax refund is based on your household income and the amount of property tax you pay on your principal residence.

Search local state and regional incentive programs which help create a business-friendly environment that supports continued economic vitality of Ramsey County Property Tax. Ramsey County Minnesota has property tax rates that come in above both state and national averages. Enter your PIN number or address. Go to Property Look Up.

Property value and assessment. They are maintained by. Easy Payment Via Phone or Internet. Click on the blue Pay Property Taxes button.

NE14 15 155 61 EB 2021 Property Tax. Tax calculators and rates. The median property tax in Ramsey County Minnesota is 2345 per year for a home worth the median value of 222700. Saint Paul MN 55107.

The special property tax refund requires your net. 90 Plato Blvd W. Ramsey County Property Tax Assessor Info Service. Ramsey County collects on average 105 of a propertys.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. 90 Plato Blvd W.

|

| 344 Summit St Paul Mn Proposed Hotel Home |

|

| Hennepin And Ramsey Counties Issue Tax Penalty Abatements Ds B |

|

| Ramsey County Unveils Plan To Fund Housing Minority Businesses |

|

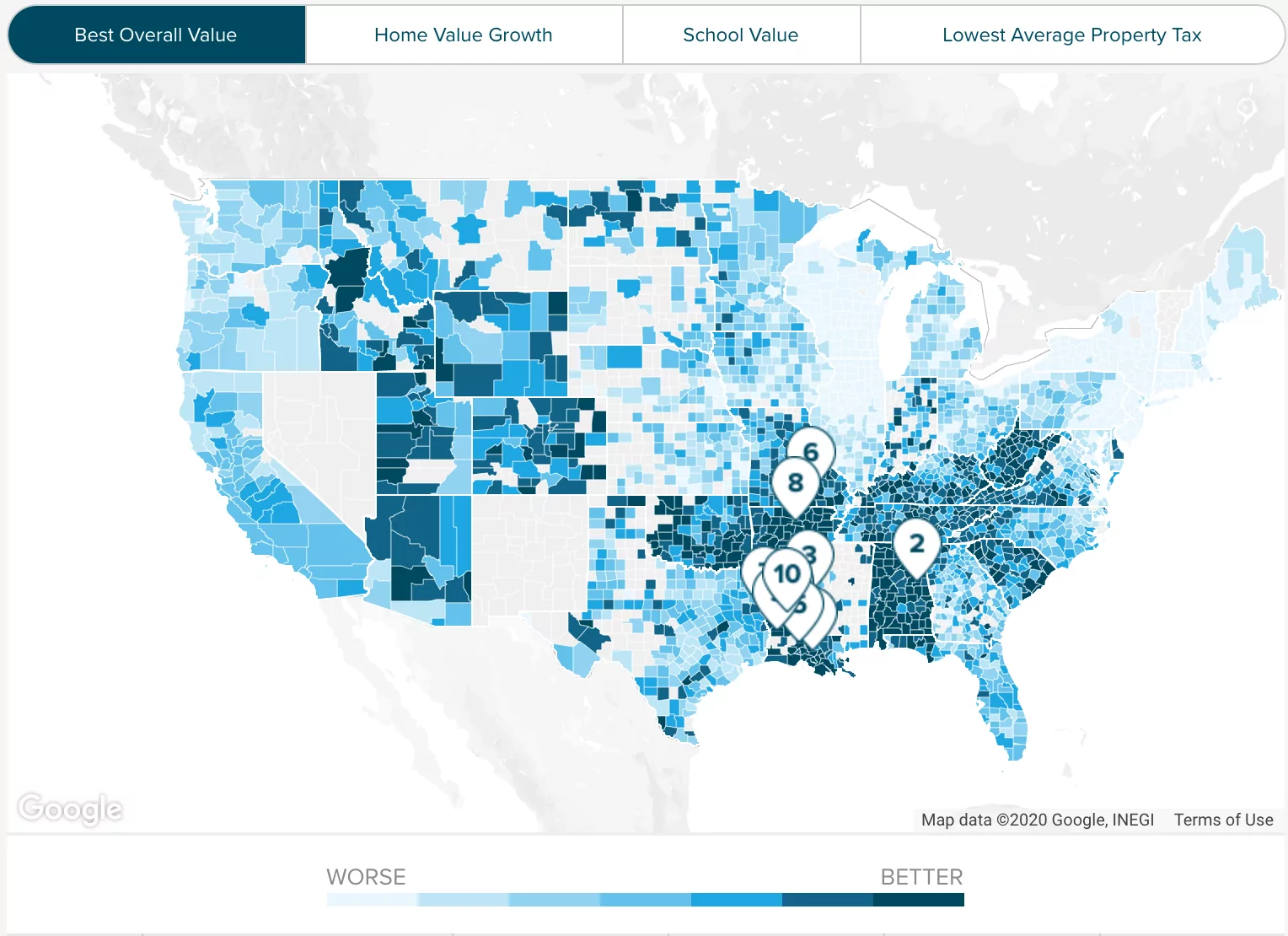

| Ramsey County Mn Property Tax Calculator Smartasset |

|

| Ramsey County Mn Property Data Real Estate Comps Statistics Reports |

Posting Komentar untuk "ramsey county property tax"